- Call Us Now 020 3728 4700

Arigal Consulting is a trading style of Access Financial Services which is authorised and regulated by the Financial Conduct Authority. Financial Services Register number is 301173.

You can check this on the Financial Services Register by visiting the FCA’s website www.fca.org.uk/firms/systems-reporting/register or by contacting the FCA on 0800 111 6768.

The FCA is the independent watchdog that regulates financial services. Use this disclosure document to decide if our services our right for you. It explains the service we offer and how you will pay for it.

Our Service

Our service and permitted business includes advising and arranging mortgages and insurance products as stated below:

Residential mortgages:-

Fees vary according to individual circumstances and we will agree our fees with you before we undertake any chargeable work. This fee is for advice, research, recommendation, implementation (e.g. application, administration of arranging the loan). We will also be paid by commission from the lender.

Product Transfer - £495

Existing client / Mortgage Capacity Letter

Standard - £1495

Standard Mortgage / Standard Remortgage / Further Advance / Product Transfer for a new client

Complex - £1995

Debt Consolidation / Adverse Credit / Government Scheme / Three Applicants / mortgage term beyond age 80 without pension income

Specialist - £2495

Four applicants / Retirement Interest Only / Equity Release / Divorce / Packager case / Conducting research and due diligence for over 4 weeks / Paper application

Bespoke - £4995

High Net Worth / Probate / Expedited

Second Charge – 1.5%, up to a maximum of £5,000

Our fee is payable on receipt of the Decision in Principle and will never be more than 2% of the amount being borrowed.

Business Buy-To-Let; Consumer Buy-To-let:-

Fees vary according to individual circumstances and we will agree our fees with you before we undertake any chargeable work. This fee is for advice, research, recommendation, implementation (e.g. application, administration of arranging the loan). We will also be paid by commission from the lender.

Product Transfer - £495

Existing client

Standard - £1995

Standard Mortgage / Remortgage / Further Advance / Product Transfer new client / Ltd company

Complex - £2495

Debt Consolidation / Adverse Credit / Three Applicants

Specialist - £2995

Four applicants / Packager / HMO Ltd Company

Bespoke - £4995

High Net Worth / Probate / Expedited

Second Charge – 1.5%, up to a maximum of £5,000

Our fee is payable on receipt of the Decision in Principle and will never be more than 2% of the amount being borrowed.

Bridging:-

Less than £10m – 2%

More than £10m – 1%

Commercial:-

Less than £1m – 2%

More than £1m – 1%

Complaints

We have a full complaints handling process. You can download a PDF file detailing that process HERE.

If you cannot settle your complaint with us, you may be entitled to refer it to the Financial Ombudsman Service ( www.financial-ombudsman.org.uk ). That process is also detailed in the same document.

Financial Services Compensation Scheme

We are covered by the FSCS. You may be entitled to compensation from the scheme if we cannot meet our obligations. This depends on the type of business and the circumstances of the claim.

- Insurance advising and arranging is covered for 90% of the claim, without any upper limit.

- Mortgage advising and arranging is covered up to a maximum limit of £50,000.

Further information about the compensation scheme arrangements is available from the FSCS.

Privacy Policy

You can read our privacy policy by clicking HERE

You can download our privacy policy as a PDF file by clicking HERE.

How to contact us

If you wish to contact us about the above or any other matter, then please contact us at:

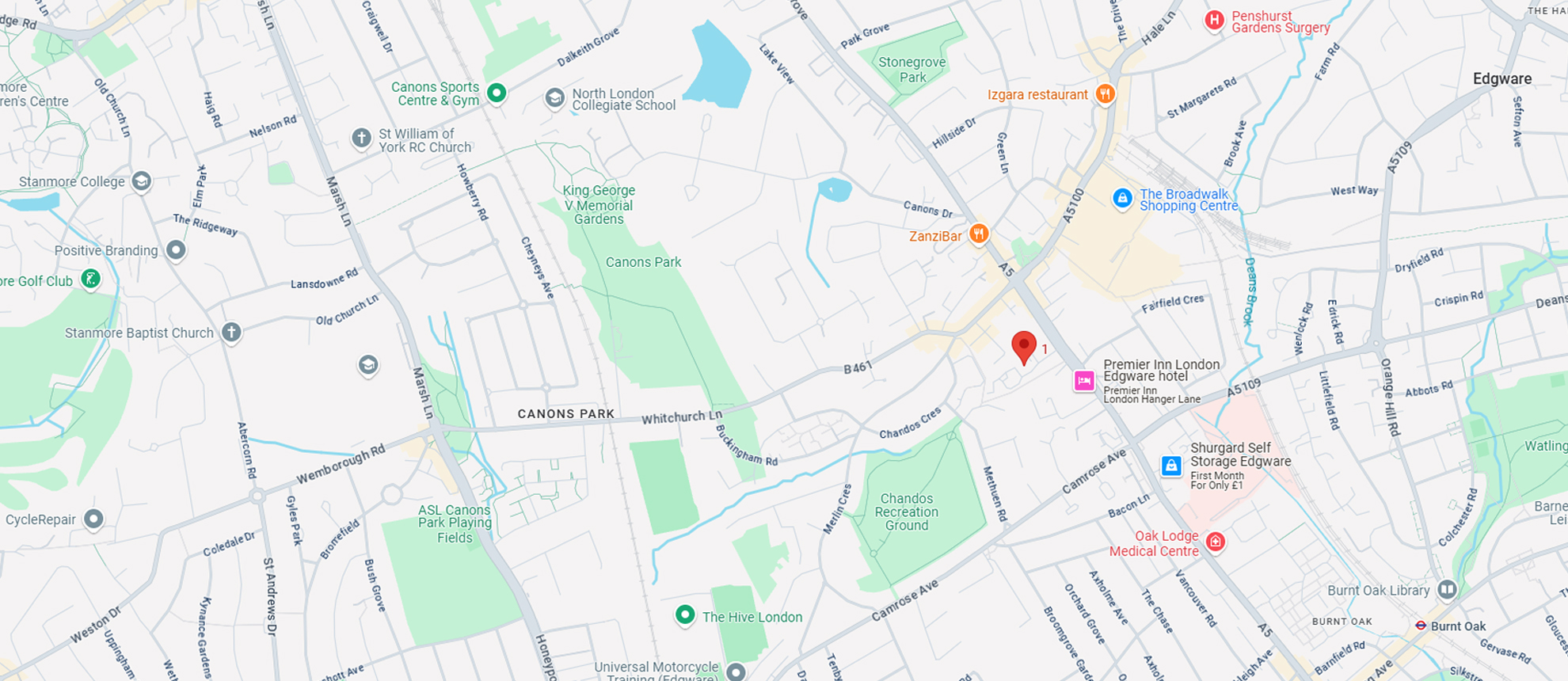

Arigal Consulting, NW London Office, 1 Spring Villa Park, Spring Villa Road, Edgware HA8 7EB

Tel: 020 3728 4700

Email: info@arigalconsulting.co.uk